Commission Split Analysis: Company vs Independent Contractor Roofing

Oct 14, 2025

Same Roof, Different Paychecks—What's the Difference?

Picture this: Two guys both closed a $22K roof replacement. Same neighborhood, similar damage, identical materials.

Rep A walked away with $1,760 in his pocket. Rep B? He got $880.

The only difference? Their commission structure.

I spent my entire roofing career as a company employee, pulling a base salary plus commission splits that ranged from 3-6% depending on the job size.

Not bad, right? Steady paycheck, benefits, the whole nine yards.

But I kept meeting these independent contractors at industry events who were bragging about 10-15% commission rates on the same exact jobs I was selling.

That got me curious. So I started digging into the real numbers behind company employment versus 1099 contractor setups.

What I found was eye-opening—and honestly a little frustrating when I realized what I might've been leaving on the table.

The truth is, commission structures in roofing vary wildly depending on whether you're on payroll or working as an independent contractor. Each setup has serious advantages and some brutal downsides that most people don't talk about.

This breakdown covers the real math behind both approaches, including tax implications, risk factors, and which setup actually puts more money in your bank account at the end of the year.

What You’ll Learn:

- How commission splits work for W-2 vs 1099 roofing reps

- Typical pay structures and income examples

- Pros and cons of company vs independent contractor roles

- Legal, tax, and benefits differences

- How to choose the right model for your goals

Definitions – Company Rep vs Independent Contractor in Roofing

Understanding whether you're a W-2 employee or 1099 contractor makes a huge difference in how bonuses and compensation work. Both have their pros and cons depending on your situation.

Company Rep (W-2): You're an actual employee of the roofing company. This means regular paychecks with taxes automatically withheld, which is nice for budgeting.

The trade-off?

Usually lower commission percentages since the company is covering your benefits, unemployment insurance, and employer taxes.

But you get health insurance, paid time off, and that safety net of a steady paycheck.

Independent Contractor (1099): You're basically running your own mini-business under their umbrella. No taxes withheld means bigger checks, but you're responsible for quarterly tax payments, your own insurance, tools, and business expenses.

The upside is higher commission percentages since the company isn't covering benefits.

Here's a real example from my experience: as a W-2 employee, I earned a $500 weekly salary plus 5% commission on company-generated leads and 8% on self-generated ones.

Seemed lower than the 1099 guys getting 12-15%, but when I factored in health insurance ($400/month), paid vacation, and not worrying about quarterly taxes, the W-2 structure actually worked out better for my family situation.

The key is understanding what structure fits your lifestyle and risk tolerance.

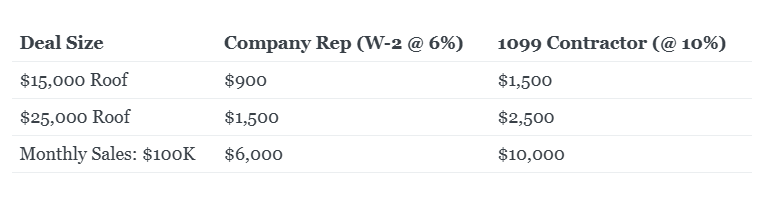

Typical Commission Split Examples (W-2 vs 1099)

The commission differences between W-2 and 1099 structures are pretty significant, and understanding them is crucial for maximizing your earning potential.

W-2 employees typically see 4-6% commission rates. Sounds low compared to contractors, but there's usually more stability built in.

Many companies offer draw programs where you get $2,000-3,000 monthly guaranteed against future commissions. This smooths out those brutal slow months when weather kills your sales pipeline.

1099 contractors often earn 8-12% or even higher on self-generated leads. I've seen experienced contractors negotiate 15% on their own leads, especially if they're bringing established referral networks.

The trade-off is zero safety net - no sales means no paycheck.

Here's where it gets interesting: bonus structures can actually make W-2 positions more lucrative than they appear. A W-2 rep earning 5% plus volume bonuses, self-gen bonuses, and year-end retention payments might out-earn a 1099 contractor at 10% who doesn't hustle for bonuses.

The volatility factor is huge too. 1099 reps deal with feast-or-famine cycles - $15K months followed by $2K months. W-2 structures with draws and salary components reduce that roller coaster, which is worth considering if you've got mortgage payments and kids to feed.

Smart reps run the math on both structures before making moves. Sometimes that "lower" W-2 percentage actually puts more money in your pocket annually.

Pros and Cons of Being a Company Roofing Sales Rep (W-2)

Being a W-2 employee in roofing sales is like choosing stability over pure earning potential. It's not the right fit for everyone, but for certain situations and personality types, it makes perfect sense.

The biggest advantage is that consistent paycheck. When you've got a mortgage and car payments, knowing exactly what's hitting your bank account every two weeks is incredibly valuable.

Add in the fact that payroll taxes are handled automatically - no quarterly payments or self-employment tax headaches.

Benefits are where W-2 positions really shine. Health insurance alone can save you $400-600 monthly, plus you get dental, PTO, and often a 401(k) match.

The onboarding and training support is usually much better too. Most companies invest heavily in their W-2 reps with CRM training, sales methodology, and ongoing coaching.

But here's the reality check - you're trading earning potential for security. Those lower commission percentages (4-6% vs 10-15%) really add up during busy seasons.

I've watched 1099 contractors pull $25K months while W-2 reps with similar skills maxed out around $12K because of company caps or structured pay scales.

Pros:

- Consistent paycheck with automatic tax handling

- Full benefits package (health, dental, PTO, 401k)

- Structured training and ongoing support

- Stability during slow winter months

- Better suited for retail-focused sales processes

Cons:

- Lower commission percentages (typically 4-6%)

- Income caps and quota-driven limitations

- Less flexibility in work schedules and sales processes

- Minimal control over job pricing and profit margins

- Reduced earning potential during peak storm seasons

Pros and Cons of Being a 1099 Independent Roofing Contractor

Going the 1099 route is basically betting on yourself. You're trading security for unlimited earning potential, and honestly, it's not for everyone. But for the right personality type, it can be incredibly rewarding both financially and personally.

The commission difference is what catches most people's attention first.

We're talking 8-15% versus the 4-6% that W-2 reps typically see. On a $25K job, that's the difference between $1,250 and $3,750. Those numbers add up fast during busy seasons.

What I love about the 1099 structure is the control. You can work your own hours, develop your sales process, and really go all-in on lead generation strategies that work for your personality.

Want to focus entirely on door-knocking after hail storms? Go for it.

Prefer building referral networks with insurance adjusters? That's your call.

But here's the brutal truth - there's zero safety net. No sales means no income, period. You're handling your own taxes, health insurance, and retirement planning.

When a job goes sideways or paperwork gets messed up, you're the one dealing with it.

The isolation factor is real too. No team meetings, no built-in support system.

Success depends entirely on your self-discipline and ability to stay motivated during slow periods.

Pros:

- Higher commission percentages (typically 8-15%)

- Complete control over sales process and lead generation

- Flexible hours and business approach

- Easy to scale through referrals, teams, or self-generation

- Unlimited earning potential with high-volume production

Cons:

- No guaranteed income or employee benefits

- Responsible for taxes, insurance, and retirement planning

- Liable for job errors, issues, and paperwork problems

- Can feel isolated without company support structure

- Success heavily dependent on personal self-discipline

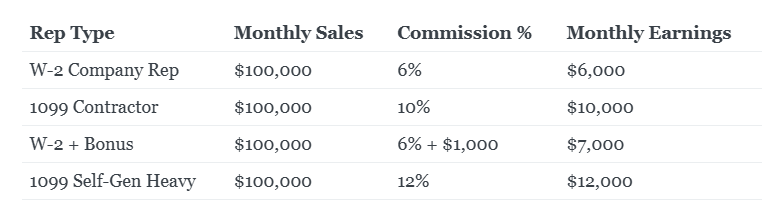

Real Income Scenario: Company vs Contractor

Let's break down what these different structures actually mean for your monthly take-home. Using $100K in monthly sales across all scenarios, the differences might surprise you.

Basic W-2 Rep (6% commission): $100K × 6% = $6,000 gross monthly. Add benefits value of $700/month (health insurance, PTO, 401k matching) and your total compensation package hits $6,700.

Standard 1099 Contractor (10%): $100K × 10% = $10,000 gross. Subtract self-employment tax ($765) and business expenses ($250/month for insurance, gas, tools) leaves you with $8,985 net.

W-2 + Bonus Rep (6% + $1,000 bonus): $6,000 commission + $1,000 monthly bonus + $700 benefits value = $7,700 total compensation. Still lower than the basic contractor, but the gap is closing.

1099 Self-Gen Heavy Rep (12%): This is where contractors really shine. $100K × 12% = $12,000 gross. After taxes and expenses ($1,165 total), you're looking at $10,835 net monthly.

The 1099 self-gen rep clearly wins on pure dollars, but remember - that $100K monthly production needs to be consistent. W-2 reps have that safety net during slow months.

Who Should Choose Company vs Contractor?

The choice between W-2 and 1099 isn't just about money - it's about knowing yourself and what stage you're at in your career. I've seen great reps fail miserably because they picked the wrong structure for their personality.

Choose W-2 (Company Rep) if you…

- Want structure, training, and comprehensive onboarding

- Prefer consistent paychecks and full benefits packages

- Are new to roofing sales or sales in general

- Value mentorship, team culture, and built-in support systems

New reps especially should consider W-2 positions first. Learning roofing sales is tough enough without also figuring out tax planning, insurance options, and lead generation systems.

The training programs at established companies can shave months off your learning curve.

Choose 1099 (Independent) if you…

- Want to maximize earning potential and aren't afraid of income volatility

- Are confident in self-management and lead generation abilities

- Don't need or want corporate structure and micromanagement

- Plan to scale through referrals, teams, or advanced self-gen strategies

The 1099 route works best for experienced reps who already understand the sales cycle and have proven lead generation skills.

If you're the type who gets energized by total control over your schedule and process, contracting can be incredibly rewarding.

Here's my honest take: start W-2 to learn the business, then evaluate switching to 1099 once you've got 12-18 months under your belt and consistent $80K+ monthly production. Best of both worlds.

Commission Splits Aren’t Just Math—They’re Strategy

In roofing sales, how you get paid determines how you work, how you grow, and how you build wealth. Company reps trade some upside for stability. Contractors take on risk for higher rewards.

Neither is right or wrong—it depends on your goals. But don’t take a deal you don’t understand. Run the numbers, ask the questions, and pick the path that lets you control your income story.