How To Use Your Financial Freedom Money System (Free Download)

“If your income goes up and down, your budget needs to flex with it.”

Budgeting on commission isn’t optional—It’s survival.

You know that sick feeling when you check your bank account after a slow month, right? When you made $18,000 in March but only $2,800 in April, and suddenly you're sweating about your truck payment.

Roofing sales isn’t some cushy 9-to-5 office job. You don’t get a steady paycheck or guaranteed hours. You're grinding through rejection, chasing storm damage, and praying your pipeline converts.

Some weeks you crush it, others you’re chasing insurance claims or hoping a lead calls back.

That feast-or-famine cycle is killing your dreams. Maybe it's the boat you want, that bigger house for your family, or just sleeping peacefully without money stress. You can't build wealth when you're constantly playing financial defense.

That’s why you can’t use a basic budget template made for salaried employees.

You need a custom variable income system built specifically for roofers, with tools that let you:

- Smooth out your rollercoaster income so you're not living paycheck to paycheck

- Anticipate slow spells and finally stop panicking during slow seasons

- And finally feel in control of your money.

This exact system helped me pay off my mortgage in 16 months—even on a rollercoaster commission income.

What You'll Learn:

- Why traditional budgets fail roofing pros

- How to use this flexible, variable-income budget

- Features inside the free template

- Download + video walkthrough included

Why Traditional Budgets Don’t Work for Roofers

If you've ever tried cramming your roofing income into one of those "perfect budget" templates, you probably wanted to throw your laptop out the window.

I get it – because those budgets are built for people who've never had to explain why they made $15,000 last month but only $3,200 this month. Here's the thing – most budgeting templates were designed for people pulling in the same $4,000 every month like clockwork.

But when you're making $12,000 one month because you knocked out three big jobs, then $2,500 the next because weather was garbage? Those neat little categories fall apart fast.

You know exactly what I'm talking about. You have that killer month where commissions are flowing, so you upgrade your truck, buy better gear, maybe even splurge on that family vacation you've been promising.

Then reality hits when the leads dry up or storms stop coming, and suddenly you're stressing about basic bills.

The real killer is that inconsistent income messes with your head. You start living like that best month is your new normal, but then reality hits and you're stressed about every bill that comes in.

What works better is what I call "income smoothing" – basically setting up a separate personal bank account where you stash extra from good months, then pay yourself consistently during the lean times. Takes discipline, but it'll save you from those 3 AM money panics.

What Makes This Template Work for Roofing Sales Income

After watching too many roofers stress about money during slow seasons, I built this system around how our income actually works – not how some finance guru thinks it should work.

The backbone is what I call your "bare bones budget" tracker. You need to know exactly what survival mode costs you – mortgage, utilities, groceries, insurance.

That's your non-negotiable number. When you know that figure down to the penny, everything else becomes manageable.

The income section lets you plan for the worst while tracking what actually hits your account. I always tell people to budget off their lowest quarter, then celebrate when reality beats expectations.

And here's the kicker – grab the sales forecaster spreadsheet too when you download this.

It's perfect for tracking your pipeline and KPIs alongside your personal wealth building.

What really sets this apart is the priority-based spending system.

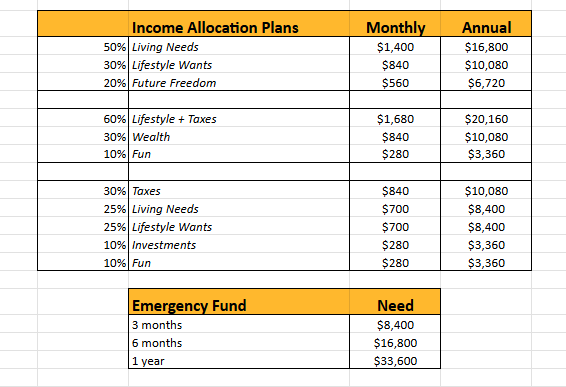

Everything flows through percentages into different accounts – essentials first, then your goals, then the fun stuff. No more guessing games about where money should go.

The slow season buffer is where most people mess up.

This template shows you exactly how much to sock away based on your personal comfort level. Some folks need six months saved, others are fine with three. The system adapts to what lets you sleep at night.

Best part? It's all in Google Sheets, so you can tweak it however you want.

Template Features Overview

This isn't just another boring spreadsheet – it's basically your financial command center for the next three years.

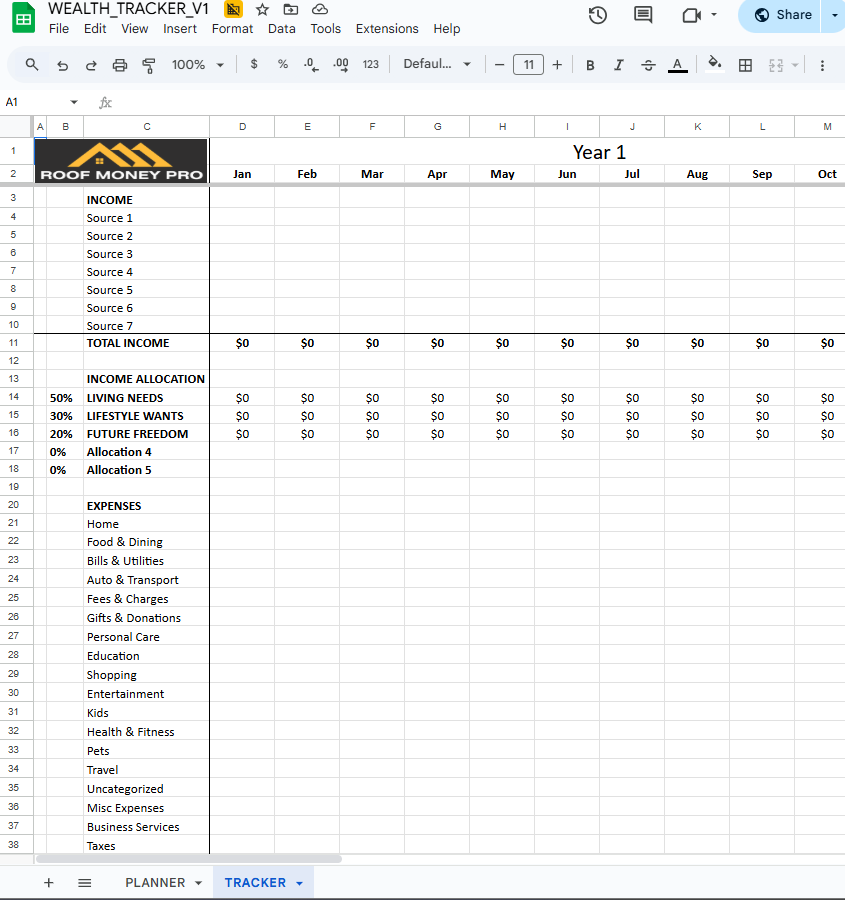

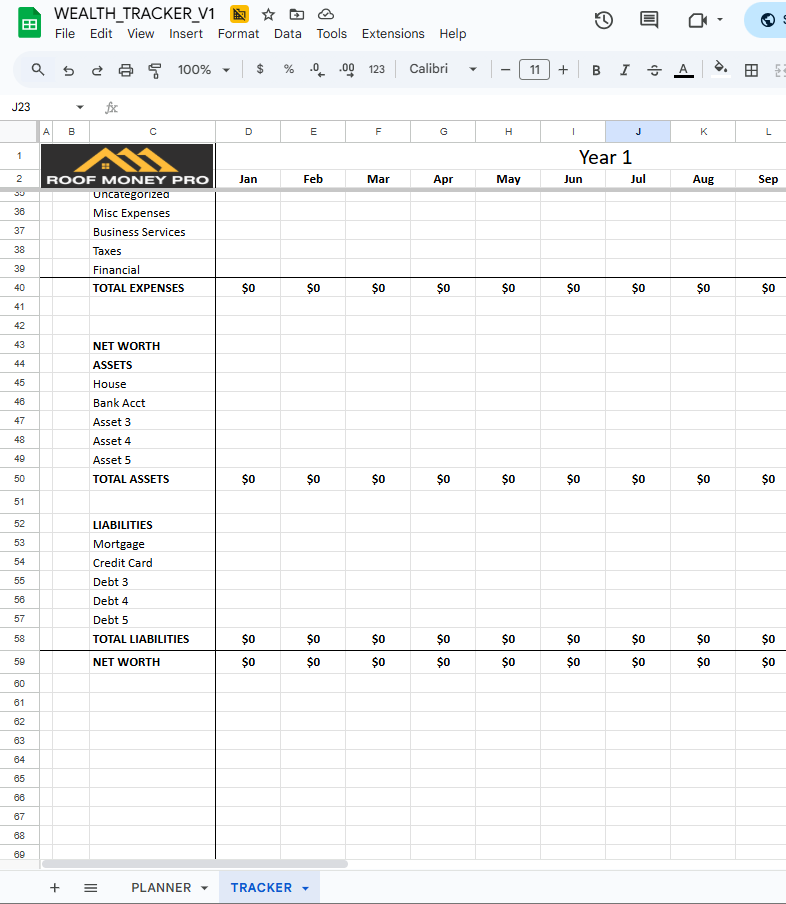

The monthly tracker captures everything that matters: what actually came in, what went out, and how your net worth changes over time.

I've seen too many people lose track of their progress because they weren't measuring consistently. This keeps you honest about where you really stand.

The financial independence calculator is my favorite part.

Punch in your numbers and it'll tell you exactly what "retire comfortably" costs based on your lifestyle. No more wondering if you're on track or shooting in the dark with some generic retirement advice.

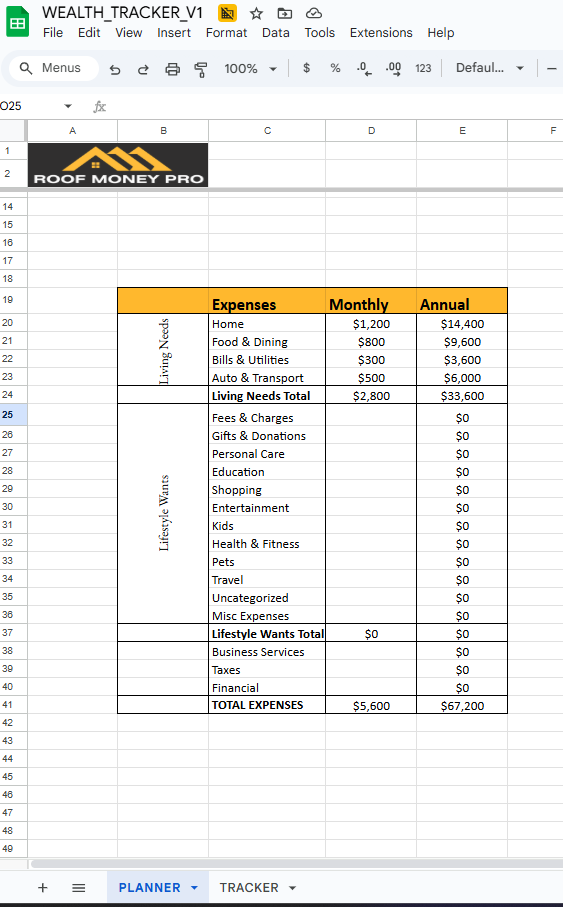

Your spending gets sorted into four buckets that actually make sense: living needs (the stuff that keeps lights on), lifestyle wants (because life's gotta be enjoyable), future freedom (savings, investing, debt destruction), and taxes if you're 1099 (because Uncle Sam always gets his cut).

The cash reserves section is pure gold for anyone dealing with seasonal income swings. It calculates exactly how much cushion you need based on your slow months, so you're never scrambling when leads dry up.

And the visual stuff? Game changer.

Free Download + How to Use It

Okay, I'm gonna be real with you - I used to track my finances on sticky notes and scribble in random notebooks and wondered why I was always stressed about money. What a disaster that was.

After years of helping clients figure out their financial mess, I finally created this wealth tracker that doesn't make your brain hurt.

Download the Google Sheets template here - just click to copy it straight to your drive.

Here's what makes this different from those overcomplicated budgeting apps. First, you'll set your baseline using your actual survival needs - not some fantasy number.

Then there's this 3-year tracker section where you dump everything: commissions, expenses, assets, even those credit card balances you've been ignoring.

The savings target planner is my favorite part.

You can set multiple goals - 3 months emergency fund, 6 months, vacation money, whatever. The percentage allocation plan comes preset with popular strategies like 50/30/20, but you can totally customize it if you're feeling fancy.

But here's the secret sauce - you gotta use this thing weekly AND monthly. Weekly check-ins stop that "oh crap, where did my money go" panic. Monthly reviews show you the bigger picture.

I've watched too many people get overwhelmed by complex financial tracking. This keeps it simple but thorough.

Pro Tips to Make It Work in Real Life

Here's where the rubber meets the road – because having a fancy template means nothing if you're not using it right.

First rule: budget off your worst month, not your best.

I know it's tempting to plan around that $20,000 commission month, but that's how you end up eating ramen when things slow down. Look at your lowest earning month from last year and build your baseline there.

Everything above that becomes your wealth-building fuel.

Every single check that hits your account needs a job assignment before you even think about spending it. I split mine four ways immediately: expenses, savings, taxes, and buffer money. No exceptions.

Treat it like you're the CEO of your own financial company – because you are.

That one-month buffer is non-negotiable. Your income's gonna be all over the place, but your spending doesn't have to ride that roller coaster with you. I've watched too many people stress about rent because they didn't plan for the inevitable slow spell.

Here's the hardest part: don't upgrade your lifestyle until you've hit your savings goals.

That new truck can wait another quarter if it means you're building real wealth. I learned this the hard way when I upgraded everything after a great year, then had to downgrade when business got tight. Super embarrassing and totally avoidable.

Mistakes Roofing Pros Make with Budgeting

I've seen the same financial train wrecks over and over again, and honestly, most of them are totally preventable.

The biggest killer? Not saving for taxes or the slow season.

You'll have guys making $150K during storm season, then scrambling to pay their quarterly taxes or freaking out when December rolls around with zero leads.

Set aside 25-30% for taxes immediately, and build that off-season fund like your life depends on it – because it kinda does.

Then there's the feast-or-famine spending cycle. You land three roofs in one week, suddenly you're buying rounds for everyone and upgrading your gear. But when leads dry up two months later, you're stressed about grocery money.

Been there, and it sucks.

Here's what really gets me frustrated – people quit their financial plan right when they need it most. Slow month hits, income drops, and they throw their hands up like "this isn't working." That's exactly when you need to stick to the plan!

Most plans fail because they're overcomplicated. If you need a finance degree to understand your own expense planning, you're doing it wrong. Keep it simple enough that you'll actually use it when you're tired after a 12-hour day on rooftops.

And without a weekly money routine? Forget it. Pick one day to review everything – I do Sundays with coffee. Makes all the difference.

The Template That Matches Your Roofing Career

This industry is full of highs and lows. It will chew you up and spit you out if you're not financially prepared. I've watched too many talented roofers burn out not because they couldn't sell, but because the money stress became unbearable.

Your income's gonna be all over the map – that's just the nature of commission work. But your financial security doesn't have to ride that same crazy rollercoaster.

This template isn't some theoretical nonsense created by someone who's never stood on a roof or dealt with a difficult adjuster.

It's built by someone who knows what it's like to have three deals fall through in one week, or to land a $40,000 job right when you thought you'd have to dip into savings.

Here's the thing – it's not about micromanaging every dollar or living like a monk.

It's about creating that steady foundation so when the inevitable slow months hit, you're not losing sleep over bills. When storm season comes and you're crushing it, you're building real wealth instead of just spending everything that comes in.

The best part? You'll finally stop feeling like you're constantly behind. No more feast-or-famine stress, no more wondering if this career can actually build the life you want.

Your roofing career has enough uncertainty. Your finances don't have to.

👉 Download the free roofing-specific budget template now and start taking control of your variable income.