Tiered vs Flat Commission: Which Structure Pays More in Roofing?

Your commission model can make—or break—your roofing career.

If you're in roofing sales, you’ve probably heard the debate: tiered vs flat commission. One pays the same per job, no matter what. The other rewards volume with higher percentages.

"It’s not how many roofs you sell—it’s how you get paid for them."

So… which one actually pays more?

The truth? It depends on your habits, deal flow, and company structure.

This guide breaks down both models so you can make the best choice for your goals, whether you're just getting started or pushing for top producer status.

What You’ll Learn:

- Clear definitions and real examples of flat vs tiered commission

- Which reps benefit most from each model

- Pros and cons of each structure

- Real math: side-by-side income comparisons

- How to evaluate which system works best for YOU

What Is Flat Commission in Roofing Sales?

Look, when I first got into roofing sales, I was confused as hell about commission structures. Everyone was throwing around different percentages and terms I'd never heard before.

But flat commission?

That's actually the simplest one to wrap your head around.

Flat commission means you get a fixed percentage on every single job you close, no matter what. Period. Whether you sell one roof or fifty roofs that month, your percentage stays exactly the same.

When I started out, I was earning a straight 10% commission on every project - didn't matter if it was a $8,000 repair or a $25,000 full replacement.

Most companies offer somewhere between 8% and 12% for flat commission structures.

I've seen newer reps get offered 8%, while experienced guys might negotiate up to 12% or even higher if they've got the track record.

The beauty of flat commission is the predictable income and dead simple math.

You close a $15,000 job at 10%? You're making $1,500. No complicated calculations or worrying about hitting certain thresholds.

Both storm restoration companies and retail roofing outfits use this structure pretty regularly.

It's especially popular for newer salespeople or those all-in-one reps who handle everything from lead generation to final installation oversight.

Makes budgeting way easier when you know exactly what each sale's gonna put in your pocket.

What Is Tiered Commission in Roofing Sales?

Tiered commission is where things get interesting - and honestly, sometimes way too complicated. Instead of that simple flat rate, your percentage actually increases as you sell more volume each month or quarter.

A typical setup might look like 8% on your first $100,000 in sales, then bump up to 10% on everything between $100k-$200k, and maybe 12% beyond that.

The idea is to reward consistency and push high performers to keep grinding.

But man, some companies go absolutely nuts with this stuff. My old company had this ridiculously over-engineered system that still gives me headaches thinking about it.

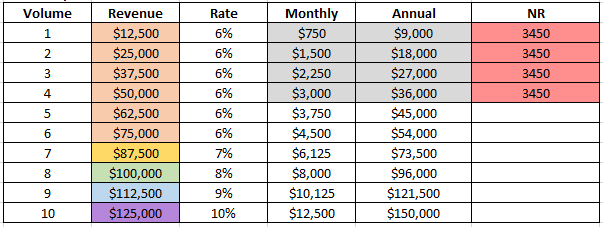

We started at 6% commission up to $75,000, then 7% between $75k to $87,500, 8% between $87,500 to $100,000, 9% between $100,000 to $112,500, and finally 10% beyond that.

Oh, and they threw in a non-recoverable draw of $3,450 if you didn't hit $50,000 in revenue.

I spent more time calculating potential earnings than actually selling roofs some months.

The upside? If you're crushing your numbers, tiered structures can seriously boost your income.

That jump from 8% to 12% on a $30,000 job means an extra $1,200 in your pocket.

You'll typically see these in competitive markets or companies with aggressive sales cultures where they're trying to separate the wheat from the chaff.

Side-by-Side Income Comparison (Real Examples)

Alright, let's cut through the BS and look at actual numbers. I've run these calculations way too many times trying to figure out which structure was better for my income.

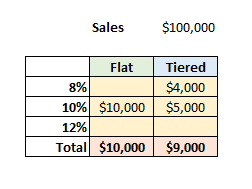

Let's say you have a solid $100K sales month. With flat 10% commission, you're walking away with $10,000. Pretty straightforward, right?

Now that same month under a tiered system - let's use 8% on the first $50K, then 10% on the next $50K.

You'd earn $4,000 on the first chunk, plus $5,000 on the second chunk, totaling $9,000.

You actually made less money!

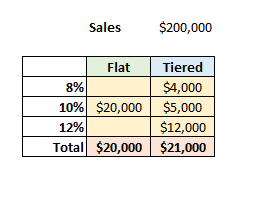

But here's where tiered gets interesting. What happens when you crush a $200K month?

With flat 10%, you're still making $20,000.

But with tiered - assuming it jumps to 12% after $100K - you'd make $4,000 + $5,000 + $12,000 = $21,000.

Here's what really opened my eyes though. If you look at a rep selling around $1.2 million annually, the math gets pretty telling.

Under flat 10% commission, they'd make $120,000 for the year.

But with a tiered structure that rewards those bigger months? They could easily pull in $130,000-$140,000 because those higher percentages really compound.

The catch is consistency matters more with tiered structures. If you're having feast-or-famine months, flat commission usually wins out. But if you can maintain steady high performance, those tier jumps really add up over a full year.

Pros and Cons of Flat Commission

After years of dealing with different commission structures, I've got some strong feelings about flat commission. Let me break down what I've learned the hard way.

The Good Stuff

First off, flat commission is ridiculously easy to understand. No spreadsheets, no confusing calculations - you close a deal, you know exactly what you're making.

When I was on that 10% flat rate, I could literally do the math in my head while sitting in someone's driveway.

It's also a lifesaver for planning your finances.

Those months where you only close two jobs instead of six? You're not getting completely screwed because your percentage dropped. Your income might be lower, but at least you know what to expect per sale.

Plus, flat commission actually makes you a better salesperson.

Since you can't chase volume to boost your percentage, you focus on pricing discipline and selling higher-value jobs. No more racing to close cheap repairs just to hit some arbitrary threshold.

The Not-So-Good

But here's the kicker - there's zero built-in motivation to push harder. Whether you sell $50K or $150K that month, your rate stays the same. I've seen good reps get comfortable and coast because why kill yourself for the same percentage?

And if you're a rockstar performer?

You might be leaving serious money on the table. Those guys crushing $300K months are making the same rate as someone barely hitting $75K.

Negotiating raises are brutal too. You basically have to prove you're worth more than the company's standard rate.

Pros and Cons of Tiered Commission

Tiered commission is like that double-edged sword you hear about - it can either make you rich or drive you absolutely crazy. I've seen both sides of this coin, and trust me, the results vary wildly.

The Sweet Spots

When you're hitting your stride with tiered commission, the upside is incredible. Those top producers who consistently crush their numbers? They're making bank because those higher percentages really stack up.

I watched one guy go from making $8K a month to $15K just by pushing into those higher tiers.

It also lights a fire under your ass every single month.

You're not just trying to close deals - you're chasing that next tier because you know it bumps your whole income up. Creates this momentum where you're constantly pushing harder instead of getting comfortable.

Plus, your goals align perfectly with the company's. They want growth, you want higher percentages - everybody wins when you're crushing numbers.

The Reality Check

But man, those lower volume months hurt bad. Starting at 6% or 7% when you're used to flat 10%? It stings, especially during slow seasons like winter in some markets.

I've seen too many reps start cutting prices or chasing garbage leads just to hit volume thresholds.

Quality goes out the window when you're desperate to reach that next tier.

And forget about budgeting consistently. Some months you're killing it, others you're barely scraping by because you didn't hit the magic numbers.

Which Model Is Better for Your Personality and Goals?

Here's the thing - I've watched too many reps pick the wrong commission structure and struggle for months because they didn't really know themselves. It's not just about the money, it's about what actually motivates you to get out there and sell.

Know Your Sales DNA

Are you the type who gets fired up chasing volume targets, or do you prefer focusing on landing those high-margin jobs? I'm definitely more of a margin guy - I'd rather spend three days closing one $35,000 replacement than rushing through five small repairs. If that sounds like you, flat commission might be your sweet spot.

But if you're driven by hitting numbers and love that competitive rush? Tiered structures will keep you hungry. Those monthly targets become like a game you can't stop playing.

Your Lead Situation Matters Too

If you're generating your own leads through door-knocking or referrals, you've got more control over your pipeline. That makes tiered commission less risky because you're not at the mercy of company lead flow.

Part-time reps usually do better with flat commission because they can't chase volume like full-time guys. And honestly? If cash flow is more important than potential growth - maybe you've got kids in college or whatever - that predictable flat rate lets you sleep better at night.

I learned this the hard way: pick the structure that matches your actual work style, not just what looks good on paper.

There’s No “Best”—Only What’s Best for You

Flat commission gives you predictable income. Tiered commission gives you leverage to scale. But here’s the deal: your habits and hustle will determine which one actually pays more.

If you’re new, start with a structure that gives you room to learn without too much pressure. If you're producing consistently? Push for a tiered system that rewards your momentum.

Roofing sales is a game—your commission structure is the scoreboard. Make sure it reflects your true value.

👉 Want weekly breakdowns like this? Join the “Roofing to Riches” newsletter at RoofMoneyPro. It’s free.