SMART Goals for Roofing Sales: Build a Clear Income Target Framework

"A goal without a plan is just a wish." – Antoine de Saint-Exupéry

This quote says it all — especially in roofing sales, where your income swings as wildly as the weather.

If you're tired of guessing your way through each quarter or living off your last storm season commissions, it's time to get surgical with your strategy. SMART goals aren’t just corporate fluff — they’re the difference between aimlessly hoping and intentionally hitting $200K EVERY year.

I’ll break down how to use SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) to create an income target framework that’s made for roofers.

Whether you’re on your first year slingin’ shingles or your fifth chasing million-dollar quarters, this guide will give you clarity, direction, and — let’s be honest — more damn money.

What You’ll Learn:

- Why most roofing goals fall flat

- How to set crystal-clear income targets

- Real-world SMART goal examples for sales reps

- Tracking, adjusting, and leveling up throughout the year

Why Roofing Sales Needs SMART Goals

I'll be honest - my first three months in roofing sales were basically me throwing spaghetti at the wall and hoping something would stick. I'd tell myself "I want to make six figures this year" and then wonder why I was still scrambling for leads in December.

The problem?

Most of us confuse hope with actual strategy.

We think saying "I'm gonna crush it this quarter" counts as goal-setting.

Spoiler alert: it doesn't.

Traditional goal-setting fails hard in roofing because our income swings like a pendulum. One month you're closing $80K in jobs, the next you're wondering if that homeowner who "needs to think about it" will ever call back. Without structure, you're just riding the emotional rollercoaster.

That's where SMART goals saved my sanity.

For roofing sales, this means:

Specific: "Close 15 residential jobs" not "sell more roofs"

Measurable: Track inspection-to-close ratios (mine's 32%)

Achievable: Base targets on your actual historical data

Relevant: Focus on metrics that directly impact your commission

Time-bound: Weekly and monthly checkpoints, not just yearly dreams

SMART goals turned my chaos into a system. Now I know exactly how many appointments I need to knock to hit my numbers.

Creating Specific Income Targets

After my first year stumbling around, I got laser-focused on one thing: paying off our house balance of $175,000. I decided I'd live off just 25% of my income - about $37,500 - which meant I needed to earn exactly $150,000 that year.

Suddenly, everything clicked into place.

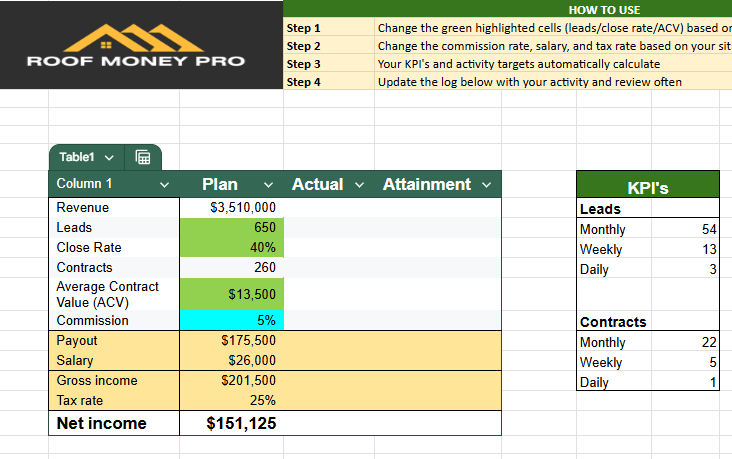

I pulled my previous year's data and did the math backwards. My average job was worth $675 in commission, and I was closing about 40% of my estimates. To hit $150K, I needed roughly 260 contracts, which meant I had to run 650 appointments for the year.

Here's where it gets real: that broke down to 54 per month. With my company providing leads of qualified prospects, and a base salary of $500 a week, I needed 13-15 solid leads weekly.

Now, that may not be the case for you. That might mean knocking 180 doors, asking for 25 referrals, and following up with 30 previous customers every single month.

See how specific that got?

Instead of "make more money," I had exact behaviors tied to exact outcomes.

Your homework: grab last year's numbers and work backwards from your target income. What's your average commission per job? Your close rate from estimates? How many touches does it take to generate a lead?

Those numbers don't lie, and they'll show you exactly what behaviors need to happen daily to hit your income goals.

Make Your Goals Measurable

I used to think I was doing great because I "stayed busy." Then I actually started tracking my numbers and realized I was busy being unproductive. Ouch.

The game-changer was setting up my planner with three areas of focus: Daily, Weekly, Monthly. Every morning I'd write down my targets and check them off as I went.

Sounds basic, but man, it worked because I keep it with me to track my activity so I'm constantly updating it throughout the day.

Here's what actually moves the needle in roofing sales:

Average deal size: Mine fluctuated between $6,800-$12,400 until I started tracking it weekly. Now I know exactly which neighborhoods and storm seasons produce higher-ticket jobs.

Job margin percentage: This one hurt to track at first - I was leaving money on the table by not upselling gutters and additional services. My margins jumped from 22% to 34% once I started measuring.

Closing percentage: Track estimates-to-signed contracts, not just leads-to-estimates. That's where the real money gets made or lost.

The formula that keeps me sane:

Target Income ÷ Average Deal Size = Jobs Needed.

Then

Jobs Needed ÷ Close Rate = Estimates Required.

I built a simple spreadsheet that does all this math automatically and forecasts my pipeline. It's honestly the most valuable tool in my business - tracks everything from door knocks to signed contracts.

Stop guessing about your numbers. Download our free Roofing Sales KPI Tracker

Achievable but Ambitious – The Sweet Spot

That $150,000 target I mentioned earlier? Honestly, it scared the hell out of me. My previous year I'd only hit $130,000, and now I was talking about a 15% jump while living on way less money.

At first I thought I was crazy.

But here's the thing about stretch goals - they need to make you uncomfortable, not impossible. I could see a path to $150K because I knew where I'd left money on the table the year before. Three deals fell through because I didn't follow up fast enough. Two customers went with competitors because I underbid by trying to be "nice."

The key was breaking that scary number into bite-sized pieces. Instead of obsessing over $150K, I focused on adding just one extra estimate per month. That felt doable, even when my brain was screaming "you're overreaching."

Early wins kept me sane. By March, I was already 8% ahead of the previous year's pace. That momentum built confidence, which led to better presentations, which led to higher close rates.

It became this awesome feedback loop.

The burnout danger is real though. I had to schedule downtime like appointments - non-negotiable family dinners and weekend mornings off. You can't sustain hunger if you're running on fumes.

Set goals that make you stretch, not snap. Your comfort zone is where good enough lives, and good enough won't pay off your house.

Relevance to Your Life & Lifestyle

Being a top closer on our team feels great, but it also creates a weird temptation. When you're pulling in good money, lifestyle inflation sneaks up fast. I've watched too many reps hit their income goals and immediately upgrade their truck, move to a bigger house, then wonder why they're still broke.

Don't get me wrong - I love the perks. But my "why" runs deeper than just buying stuff.

My real goal is wealth building, not just income earning. Even though I could afford that new F-150, I'm still driving my 2013 Tacoma because it gets me around just fine. The difference? That truck payment money goes straight into investments instead.

Here's what I've learned:

Your goals need to match where you are in your career.

New reps should focus on survival mode - consistent income, building skills, maybe paying off credit cards. But once you're established, the game changes completely.

As a top closer, my goals shifted from "make more money" to "build generational wealth." I still live off that same $37,500 budget even though my income has grown.

The extra doesn't go to lifestyle upgrades - it goes to investments and real estate.

Your goals should serve your actual priorities, not just your ego. If you want time freedom, optimize for efficiency, not just volume. If you want family legacy, focus on wealth accumulation, not flashy purchases.

Time-Bound Goals That Drive Action

Deadlines changed everything for me. Without them, I was like a ship without a rudder - drifting along hoping good things would happen eventually.

The magic happens in 90-day sprints.

Sure, I've got annual targets, but breaking them into quarterly chunks creates this sense of urgency that keeps me sharp.

Every January 1st feels too far away, but March 31st?

That's close enough to taste.

Monthly check-ins became my secret weapon. By the 25th of each month, I know exactly where I stand and what needs to happen in those final days. Sometimes it means pushing three estimates into the same week.

Other times it means making twenty follow-up calls I've been putting off.

The real power is in course-correction. Last summer, I was tracking 12% behind my Q2 target by mid-May. Instead of panicking, I analyzed what wasn't working. Turns out I was spending too much time on low-probability leads. I shifted focus to my warm referral list and closed four jobs in three weeks.

My 90-day review system is simple:

Reset (what didn't work)

Realign (adjust tactics)

Reload (set new targets)

It's like hitting a refresh button on your strategy every quarter.

Time-bound goals force decisions. When you've got 30 days to hit a number, you stop overthinking and start executing. That pressure creates diamonds, not stress - if you're prepared for it.

Adjust, Optimize, Repeat

If you aim at nothing, you'll hit nothing

Your first SMART goal is basically your rough draft - and that's perfectly fine. I've learned that flexibility beats perfectionism every single time in this business.

Market conditions shift constantly in roofing. Storm seasons bring windfalls, but they also attract more competition. Last year's hail damage hotspots might be saturated this year.

I adjust my targets quarterly based on what I'm seeing in the field.

Personal growth changes the game too. My close rate jumped from 28% to 41% after I took that 2 day sales workshop. Suddenly my original estimate targets were too low - I could hit the same income goals with fewer appointments. That's a good problem to have.

The feedback loop keeps me sharp:

Every month I spend 30 minutes reviewing what worked and what didn't.

Did my new follow-up sequence increase conversions? Are certain neighborhoods producing better margins? This reflection time always reveals patterns I missed while grinding day-to-day.

Celebrating wins is crucial, but coasting kills momentum. When I hit that $150K goal early, I didn't just cruise through December. Instead, I set a new stretch target and finished at $200K. That extra momentum carried into the next year beautifully.

Your goals should evolve as you do. The rep who knocked 200 doors last month might discover referrals work better this month. Stay flexible, track everything, and never stop optimizing your approach.

Roofing sales doesn’t have to feel like a financial rollercoaster. When you apply the SMART goals framework to your income targets, you take control of your direction — not just your destination.

You’ll stop wondering if you’ll hit $100K and start building a bulletproof roadmap to $250K.

Now that you’ve got the framework, take 30 minutes this week to draft your SMART goals. Your future self (and your bank account) will thank you.