Investing 101: A Beginner’s Guide to Getting Started

Investing might seem overwhelming at first but it's an important skill one must learn in order to grow your money and secure your financial future. For most people the allure of the stock market is both exciting and confusing. I know it was for me when I first started.

In reality there is a vast world of investment options ranging from the traditional to alternative and everything in between.

I've worked with financial advisors, became one, have multiple degrees in finance and I'm here to let you know you don't need any of that.

Whether you're building passive income streams, working towards retirement, a dream home, or just looking to make your money work for you, this guide will walk you through the essentials.

From understanding what investing is to choosing the right tools and strategies, you'll learn how to get started with confidence!

What Is Investing and Why Does It Matter?

Investing at it's core is about the balancing of risk and reward. While the average person focuses on reward and financial gain the serious investor is focused on managing risk in order to secure their reward.

It's easy to assume more risk equals more reward and therefore less risk means less reward. This thinking leads to justifying swinging for the fences with wild gambles or being way too conservative and not making a good enough return.

Essentially both routes can lead to disaster.

The primary purpose of investing is to combat the effects of inflation. A dollar today doesn't buy what it did 20 years ago and definitely won't buy as much as it does now in another 20 years. Investing is how we achieve financial independence, they simply go hand in hand.

Even if we saved consistently over our entire working career it wouldn't be enough to live off of for the remainder of our years due to the financial erosion of inflation.

When you're invested your money grows by accumulating interest. Soon the interest is gaining interest. Over time this accumulates into a sum much greater than what you originally put in.

Setting Financial Goals Before You Start

How to define clear, realistic financial goals. "Making money grow" or "be rich" isn't going to cut it. Start with answering this question: Do you want income now or are you building a future nest egg to draw upon?

Answering this simple question will give you direction on what you'll be choosing to invest in. If you're seeking income now then you'll be looking for assets that produce dividends, rent, royalties, or a business.

If you're looking for retirement income then you'll be making much different selections and they'll more concentrated in accounts like a 401k or Roth IRA. Even better, you can do all of the above.

I can't stress enough the importance of having an emergency fund before starting to invest. It is the backbone that your wealth is built upon. You need cash readily available to handle the occasional bumps of life.

First you've got to assess your risk tolerance and investment timeline. What is a reasonable rate of return and how long do you have to invest?

If you have a few decades then your investments can afford to ride some ups and downs because they have time to recover. If you're closer to retirement you may need to be a bit more conservative because your focus is more on preservation of capital rather than growth.

Historically, the overall stock market has had about a 10% average return. Take that with a grain of salt because that's over decades of historical data. It can look much different from year to year.

To keep things simple and for planning purposes you can probably use a rate of return anywhere between 5 to 10%. Let's check out how this works with an example.

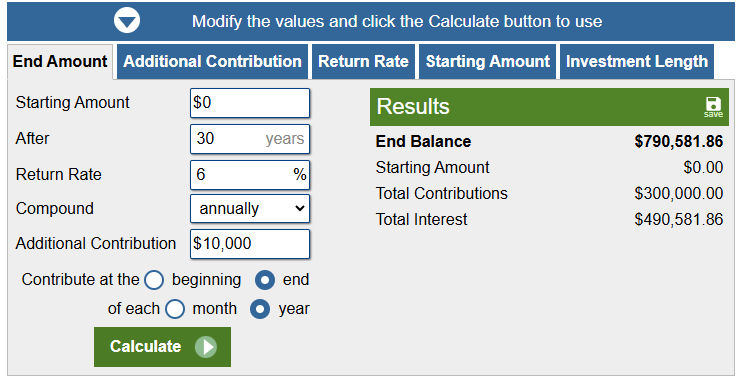

Here we assume this person is saving $10,000 a year, over a 30 year period, and their investments are earning a 6% return each year. Over the decades they will have contributed a total of $300,000 and their interest has accrued to just over $490,000, leaving them with a balance of $790,000.

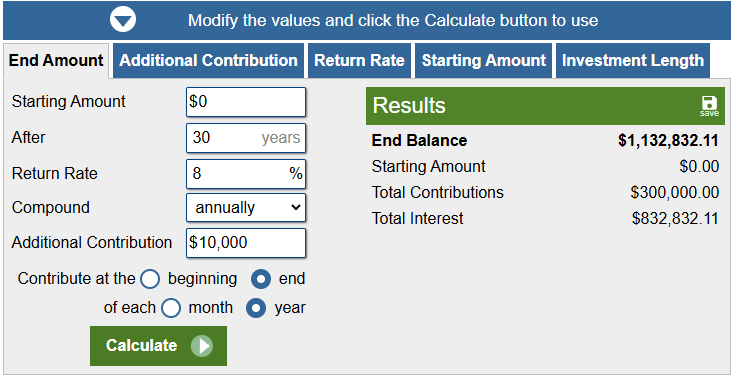

Now let's see what happens when we adjust the interest rate from 6 to 8%.

As you can see, a difference of earning 2% more interest results in $342,000 more without putting an extra dime in!

Play around with your own numbers here and see what you come up with. After you've got an idea of your timeline, amount you can invest consistently, and target interest rate, the next question is what investment vehicle will help you achieve that target interest rate.

Types of Investments for Beginners

Stocks & Bonds: What are they?

When most people think about investing the first thing that comes to mind is typically stocks and bonds.

When a company wants to grow it needs capital. This capital is provided from investors and can be in the form of equity (stocks) or loans (bonds). The investors who chose stocks are expecting that the value of the company will appreciate so that they can sell their stock for a profit and possibly earn income in the form of dividends along the way.

The investors who chose to loan their money instead through the form of bonds are trading the upside growth potential for a guaranteed income stream in the form of interest and then get their money back at the end of the term of the bond, also known as maturity.

If the company goes under the bond holders are contractually obligated to be paid off first while the stock holders will receive whatever is left and could lose their entire investment.

If you don't know how or aren't willing to dig into financial statements, assess a business, or at least understand key financial metrics then you have no business owning individual stocks.

Mutual Funds and Index Funds: Diversification made easy

The vast majority of people invest heavily in mutual funds and index funds. The reason why is because they grant instant diversification and the easiest and most cost effective way to invest in stocks and bonds.

A mutual fund is a company that professionally manages and pools money together from investors. Portfolio managers make decisions on what and when to buy or sell and a team of analysts do all of the research and market analysis to support their decision making for the overall portfolio.

A fund can hold hundreds or even thousands of different companies.

A single person would have to do their own research, incur trading costs for buying and selling, and keep up on all the industry trends that these companies operate within. That's simply not going to happen.

Also, funds offer huge buying power because some of these holdings can be extremely expensive. Let's say you have $1,000 to invest and ABC stock is trading for $500 and XYZ is trading at $2,000. You'll have to give up the opportunity to invest in one and the other will take up half of your capital which exposes you to very concentrated risk.

Now let's say that a mutual fund is invested in both of these companies 50/50 and the fund is trading at $50 per share. You can buy 20 shares of the mutual fund with your original $1,000 (20 x $50 = $1,000) and your money is invested equally in the performance of both of these companies.

Index funds

Index funds are the way cooler more handsome cousin of mutual funds and is primarily what my own investment portfolio consists of.

First let's define what an index is. An index is a measure of a specific group or industry. It is also used as a benchmark for measuring performance. You may have heard of the S&P 500, NASDAQ, or the Dow Jones Industrial Averages. These are all indices measuring major companies that affect the U.S. economy.

The idea is that if actively managed funds, such as mutual funds, have historically failed to beat the performance of the index it's measured against after fees are considered, then why not just invest in the index? If you can't beat them join them essentially.

Try buying even 1 share of each of the 500 companies in the S&P and see what that total bill runs up to. You can't invest directly in an index so there are investment companies, such as Vanguard, that create index funds designed to mimic them that way retail investors can adopt a passive investment strategy.

Because overhead is drastically reduced by not needing teams and portfolio managers the fees are drastically lower which reduces the drag on your overall returns. It's a cost effective way to grow your wealth.

Real Estate

A vast majority of millionaires hold a high percentage of their wealth in real estate.

There are a variety of ways to invest in real estate and each have their own strategies and nuances to learn about. You can fix and flip or buy and hold. Imagine having a few rental properties that pay you every single month. Perhaps it even covers your lifestyle. Imagine how that would make you feel.

Do not let anyone fool you into thinking that real estate is a sure thing. Yes you can create wealth but you can also put yourself into a serious financial whole that you may not be able to dig yourself out of.

That being said, I love it, and it is a central focus of my own investment portfolio.

Business

Often times people have told me that they would like to invest but can't because all of their money is tied up in their business. This is crazy to me because their business IS an an investment!

Owning your own business is one of the greatest pathways to build wealth. Your idea could be a start up that blows up into the next big thing. There may even be tangible assets held within the business whether it's machinery, the real estate, or the proprietary systems the business creates that are of value.

Perhaps you create multiple businesses, franchises, and partnerships throughout your lifetime. It's not for the faint of heart but absolutely a route to consider.

Building a Diversified Portfolio

Diversification is key to managing risk because it helps smooth out the bumps in performance. Industries and markets move in cycles. Even in strong economic conditions there may be some periods where everything is moving up and others where it's moving down. These movements may vary from industry to industry.

So if we understand this then we don't want all of our investments to be moving together at the same time or what we call being correlated.

This is where the most fundamental subject of investing comes into play: asset allocation.

Asset allocation is about balancing your mix of investments such as stocks, bonds, and other assets. When one investment is doing poorly you want another investment to be doing well so it doesn't drag down overall returns.

It's about taking a step back and making sure the PORTFOLIO is doing well, not just the specific investment.

In fact you may have to rebalance your portfolio from time to time. Let's say you started with a 60% stock and 40% bond mix. The stock market did really well and a year later the mix is now 70/30. You're going to sell a portion of the stock and buy more of the bonds to get back to your original asset allocation strategy.

Common Beginner Investing Mistakes to Avoid

When it comes to investing, here are the most common mistakes to avoid:

- Emotional investing and chasing trends

- Overlooking fees and expenses

- Ignoring the importance of time in the market

Emotional investing and chasing trends:

If a headline or news article causes you to panic or gives you a feeling of ecstasy then you are not investing...you're gambling. I think there's a hotline for that.

You've also got to be able to tune out the noise. This may be a headline saying the world is crashing or a co-worker who shows you a snapshot of their crypto balance and swears it's going to blast off.

You have a plan for a reason...stick to it.

Overlooking fees and expenses

This is definitely murky water because a lot of fees are tough to find and they're impact is often hidden in the numbers.

One place to start is looking at fund fees and commissions. The fund, specifically mutual funds, have something called an expense ratio. Basically this is what it costs you when you invest your dollars to keep that company running. Look for funds below 1%. Index funds typically lead the way with almost next to nothing expenses.

The next is called "load" which is a cut of your principal either taken off the top , "front-load", or when you sell, also known as "back load". A 5.95% load may not seem like much until you lose almost $6k when you invested $100k.

Fees add up and can be a significant drag on your wealth when you measure it over years.

Ignoring the importance of time in the market

The old saying goes "it's not about timing the market it's about time in the market." You've got to give your money enough time to compound and that typically takes years.

It's a snowball that will form and grow and swell and eventually be truly awesome but if you're chipping money here and there or making changes when you don't see results then that's a recipe for failure.

That also means the sooner you start the less effort you have to put in because you're money will be working for you to grow.

The best time to plant a tree is 30 years ago...the next best time is NOW.

Long-Term Strategies for Success

If you want to grow your money and build wealth, the best approach is to think long-term. Many people try to time the market or chase quick profits, but the truth is, the most successful investors stick to simple, steady strategies. Here are three powerful ways to make your money work for you over time:

Dollar-Cost Averaging: The Power of Consistency

Have you ever heard the saying, "slow and steady wins the race"? That’s exactly how dollar-cost averaging works! Instead of trying to guess the best time to invest, you invest a fixed amount of money at regular intervals—whether the market is up or down.

Why is this smart?

- You buy more shares when prices are low and fewer shares when prices are high.

- It reduces risk because you're not putting all your money in at once.

- It keeps you consistent, so you don’t panic when the market drops.

Example: Let’s say you invest $100 every month. One month, a stock costs $10 per share, so you buy 10 shares. The next month, it drops to $5 per share, so you buy 20 shares. Over time, this strategy helps balance out your buying price and grow your investment!

Reinvesting Dividends: Make Your Money Work for You

Some stocks and funds pay you extra money, called dividends, just for owning them! You could spend this money, but a smarter move is to reinvest it so it keeps growing.

Why is this powerful?

- You buy more shares automatically without adding extra money.

- Your investments grow faster because you earn money on top of your earnings (this is called compound growth).

- Over time, even small dividend payments can turn into big gains.

Example: Imagine you own 50 shares of a stock that pays a $1 dividend per share. Instead of taking the $50 in cash, you use it to buy more shares. The next time dividends are paid, you’ll earn even more because you now own more shares!

3. Set It and Forget It: Let Time Do the Work

The best investors aren’t staring at stock charts all day—they invest wisely and let time do the work. Trying to jump in and out of the market can lead to stress and losses.

Instead, the key is to stay patient and let your investments grow over years—even decades!

Growing your wealth isn’t about chasing quick wins—it’s about smart, steady moves that add up over time. By using dollar-cost averaging, reinvesting dividends, and setting your investments on autopilot, you’ll build financial security without the stress of daily market changes.

Investing is a journey that starts with small, consistent steps. By understanding the basics, setting clear goals, and choosing the right strategies, you’re well on your way to building wealth over time. Remember, the earlier you start, the more time your money has to grow.

Start small, stay patient, and let your money grow.

Your future self will thank you!