How Many Roofs to Sell Monthly for $100K Annual Income

Here's the million-dollar question (or should I say $100K question?):

How many roofs do you actually need to sell each month to hit that coveted six-figure income in roofing sales?

The answer might surprise you – it's not as many as you think!

Most roofing sales reps assume they need to sell dozens of roofs monthly to reach $100K annually.

But here's what I've learned after years in the industry: with the right commission structure and average job size, you could hit six figures selling just 2-3 roofs per month in some markets.

Of course, it's not that simple.

Your monthly roof sales target depends on several critical factors: your commission rate, average job value, market conditions, and seasonal variations.

Some reps crush $100K selling 15+ smaller jobs monthly, while others hit the same target with just 24 high-value jobs per year!

Ready to do the math on your specific situation?

Let's break down exactly how many roofs you need to sell monthly to earn $100K annually, plus the strategies to actually achieve those numbers consistently.

Check out this article for tackling $100k with backward planning

The $100K Roofing Sales Math Breakdown

I'll never forget the day I finally did the math on hitting $100K. Grabbed a calculator(spreadsheet), my commission structure, and realized I needed to sell way more roofs than I thought. The numbers were both motivating and terrifying.

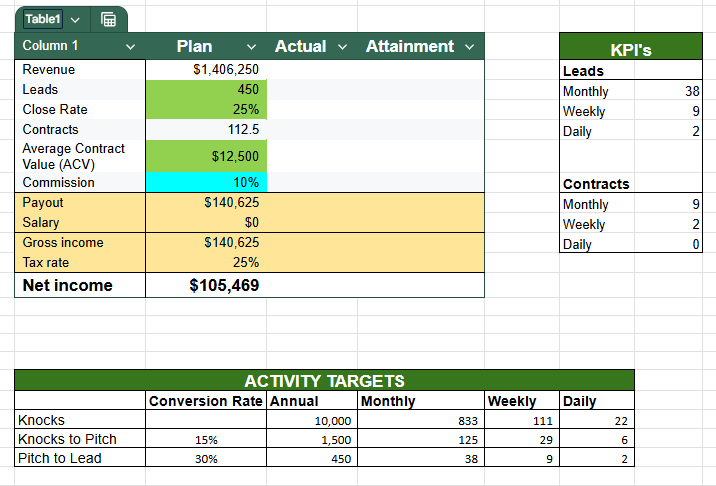

Here's the basic formula that changed my perspective: $100,000 ÷ $1,250 average commission = 113 roofs per year. Sounds simple until you factor in your close rate. If you're closing 25% of estimates, like I was at first, you need 450 estimates annually, or about 38 per month.

That's where most people's jaws drop.

Commission percentage makes a huge difference in your required activity. At 6% commission on $20K jobs, you're making $1,200 per sale and need 83 sales yearly. Bump that to 10% and you only need 50 sales. This is why I focused on replacements rather than repairs - higher percentages mean less grinding.

Average job size is the real game-changer though. My first year, I was chasing $2K repair jobs making $200 commissions. Needed 500 sales to hit six figures - basically impossible.

Now shift the focus on $25K+ replacements averaging $2,800 commissions. Same income goal, 36 sales instead of 208.

Nothing promised but a target set is more likely to get hit than not having one.

Regional variations are wild. Florida might average $32K per job during hurricane season but in Texas average $22K . Market conditions matter more than sales skills sometimes.

The real eye-opener? Time investment per sale. Each roof takes 15-20 hours from door knock to contract signing. At 40 sales yearly, that's 700+ hours of direct selling time.

Download our Sales Forecaster Spreadsheet and start predicting your income like a pro.

Average Roofing Job Values by Market Type

The sticker shock might hit you hard if you're moving from let's say, Kansas to Colorado. Same exact roof that was $14K in Wichita suddenly becomes $23K in Denver.

Materials cost the same, but labor rates and local market conditions changed everything. Regional pricing differences can make or break your income goals.

Residential jobs in my Texas market typically run $12K-$18K for basic asphalt shingle replacements. But when customers want architectural shingles or metal roofing, those numbers jump to $25K-$35K+ fast.

I learned to love selling premium materials - same amount of work, way bigger commission checks.

Storm damage jobs are absolute goldmines compared to regular replacements. Insurance companies don't negotiate like cash customers do. That $15K retail job becomes a $22K insurance claim because they're covering code upgrades, and gutters.

The margins might be lower than what our company may have typically done it for but it's enough to be profitable and the volume/supplements make up the difference.

Commercial work scares folks initially, but the numbers are insane. I've never dipped my toes personally but the smallest commercial job our company did was $45K, largest was in the millions.

Problem is, they take 3-6 months to close and require way more technical knowledge. Residential guys can make great money without that headache though so that's where I liked to stay.

The premium materials conversation changed my career. Started pushing metal roofing and high-end shingles instead of basic 3-tab. Yes, some customers walk away, but the ones who stay increase my average sale from $16K to $24K.

Quality customers pay for quality, and they refer other quality customers.

Commission Structure Impact on Monthly Sales Goals

The commission structure revelation hits a sales representative shooting for that $100k benchmark when they compare job offers from different companies.

Company A offered 5% on everything, Company B did 8% standard, and Company C paid 10% but only on jobs over $20K.

Same income goals, totally different workloads required.

At 5% commission with $18K average jobs, a salesperson makes $900 per sale. To hit $100K annually, they need 111 sales - that's 9+ roofs monthly.

Sounds brutal until you realize some markets pay way higher percentages. A rep in Florida might get 12% during hurricane season and only needs 46 sales for the same income.

The 8% sweet spot means the same $18K average job now pays $1,440 commission, dropping the required sales to 70 annually, or about 6 monthly. That's the difference between grinding every weekend and having some work-life balance.

Flat fee structures can be tricky.

Let's say one company offered $2,000 per completed job regardless of size. Sounds great until you realize they mostly do $12K repairs while their percentage-based competitors make more on bigger jobs.

If this is the case then it probably makes sense to pass because you could probably land premium customers.

Bonus tiers are where the real money hides.

A sales reps current company pays base 6%, jumps to 8% after 8 monthly sales, then 10% after 12 sales. Hit those higher tiers and the math gets crazy good. In one month they close 15 jobs - first 8 paid $1,200 each, next 4 paid $1,600 each, final 3 paid $2,000 each. That tier system added an extra $3,200 to their monthly income just for volume.

The key is understanding your realistic close rate before picking commission structures.

Lead Generation Requirements for Monthly Targets

The lead volume math shocked me when I finally tracked it properly. Turns out I was running about 30 estimates to close 4 sales - a 13% close rate that felt decent until I realized what it meant for my activity levels.

To hit 5 monthly sales, I needed 38 estimates, which required knocking roughly 600 doors. That's 20 doors daily just to maintain my income goals.

Industry averages are all over the place, but here's what I've seen after four years: decent reps close 15-18% of estimates, top performers hit 25-30%.

Door-to-door prospecting typically yields 1 appointment per 25-30 doors knocked, and about 70% of appointments result in estimates. The math gets brutal fast when you're starting out.

My door-knocking breakdown for monthly targets:

600 doors knocked → 22 appointments → 15 estimates → 2-3 sales.

Some months are better, some worse, but those ratios hold pretty steady. Peak season improves everything - same activity might yield 4-5 sales when homeowners are thinking about their roofs.

Referral generation is like a secret weapon once you get serious about it. Pay $500 for every closed referral and ask every happy customer for three neighbor introductions.

Your best customers might send you 6-8 jobs each over the years which could basically fund your truck payments through their neighborhood connections.

Quality beats quantity every time with lead sources.

Time Investment Analysis for $100K Goal

The time reality check hits hard when you actually track hours per sale.

From first door knock to signed contract, each deal might end up eating 18-22 hours of your life. At 40 sales annually for $100K, that's 800+ hours of direct selling time - PLUS all the driving, paperwork, and follow-up calls.

A monthly breakdown can get scary fast if you're not prepared for it:

40 sales divided by 8 productive months equals 5 sales monthly. At 20 hours per sale, that's 100 hours monthly just on deals that close. Add in all the estimates that don't convert, door knocking, and administrative stuff?

Working 65-70 hours weekly during peak season becomes the norm.

The efficiency breakthrough came when I started tracking where time got wasted. Biggest time suck? Driving between appointments across town. Try block scheduling by neighborhood and cut your drive time.

Also learn to qualify prospects harder upfront - stop running estimates for people who clearly can't afford new roofs.

Scaling without burnout required systems I wish I'd built earlier. Some people resort to hiring a part-time assistant to handle insurance paperwork and appointment scheduling. Fortunately my company had positions posted for that which probably save me $800 monthly and freed up 15 hours weekly for actual selling.

Work-life balance at $100K is tricky because peak earning season demands everything you've got. I work like crazy April through September, then slow down quite a bit in December.

My family understands I disappear during storm season, but I'm fully present during slow months. It's seasonal balance, not daily balance.

The burnout signs are real though - if you're working 70+ hour weeks year-round, you'll flame out fast.

Strategies to Consistently Hit Monthly Roof Targets

I've worked alongside reps who's pipeline were a huge mess - they'd track leads on random scraps of paper and lose track of half their prospects. Successful reps treat their pipeline like a science, not a hope-and-pray system.

Use what I call the "30-60-90 rule."

Always have 30 active prospects in various stages, 60 recent estimates pending decision, and 90 doors knocked weekly to keep feeding the machine. If any category drops below those numbers, you'll likely see income dip 6-8 weeks later.

The pipeline predicts everything.

Multiple lead sources prevent feast-or-famine cycles. Door knocking generates 60% of business, referrals about 25%, and bought leads can fill the gaps at 15%. When one source dries up, the others carry you through.

Creating urgency without being sleazy took years to master. Instead of fake deadlines, I focus on real consequences - insurance claim time limits, material price increases, or weather windows.

"Your insurance adjuster needs this signed by Friday or you'll have to reopen the claim" works way better than "special price expires tomorrow."

My follow-up system is obsessively simple:

Day 1 estimate, Day 3 text check-in, weekly touch via email and phone call up until between 30-45 days open before final call. Most reps give up after one follow-up, but I've closed deals on the fifth touchpoint.

Persistence beats talent every time.

Networking became my secret weapon once I stopped seeing other salespeople as competition. Now I grab coffee with insurance agents monthly and they send me 2-3 qualified leads each.

Beyond $100K: Scaling to Higher Income Levels

Hitting $150K was way harder than going from $50K to $100K - it's not just about selling more roofs. At some point, you max out your personal capacity and need to think differently about the business.

I learned this when I was working 70-hour weeks and still couldn't crack $130K consistently.

The math for $150K requires about 240 sales annually at my $625 average commission, or 20 per month year-round. This was because at this point in my career, I was earning a smaller commission at 5% but had a base salary and leads given to me.

Some people even go as far as recruiting other reps and earning 2% override commissions on their sales. Then you make money while sleeping - not a bad idea.

Building recurring revenue can be a game-changer for the right people. This could be starting a roof maintenance program where customers pay $200 annually for inspections and small repairs.

Sounds small, but 150 customers equals $30K in automatic income that requires minimal effort. It's also a pipeline for future replacement sales.

The wealth building piece is where most reps miss out. Instead of just earning more, you could invest commission checks into rental properties. Use roofing network to find deals, negotiate better prices, and even manage some properties. Now you've got passive income streams that'll outlast your door-knocking days.

Long-term thinking separates six-figure earners from true wealth builders in this industry.

So there you have it – the exact math behind earning $100K annually in roofing sales! Depending on your market and commission structure, you might need anywhere from 2-4 roofs monthly (high-value jobs) to 8-12 roofs monthly (smaller jobs).

The key isn't just knowing the numbers – it's building the systems to hit them consistently.

Remember, most successful roofing sales reps don't just stumble into six-figure incomes. They calculate their targets, track their progress religiously, and adjust their strategies based on real data.

Your monthly roof sales target is your North Star, but your daily activities are what actually get you there.

Ready to hit your $100K target? The math is simple – but the execution is where champions are made. Track your numbers, stay consistent, and watch those monthly roof sales add up to your dream income!