Common Building Wealth Mistakes Beginners Make (And How to Avoid Them)

"We don't make mistakes, we have happy accidents." – Bob Ross

Let’s be real: building wealth isn't rocket science. But it is easy to mess up—especially when you're just getting started.

Most people don't fail at wealth—they sabotage it.

I've seen it all. People with good jobs, decent income, even some savings... but they’re still stuck financially because of simple, avoidable mistakes. Here's the thing I've learned over the years about mistakes. They only turn into failures when we don't learn from them.

In this guide, I’ll walk you through the most common wealth-killing habits and missteps beginners make—and exactly how to avoid them so you can get ahead faster.

Mistake #1 — Waiting Too Long to Start

I spent two years telling myself I'd start investing "when I got my next raise." Meanwhile, I was buying $6 coffee every morning and wondering why I couldn't afford to save money. Classic.

Here's the brutal truth I learned – I was waiting for permission that was never gonna come. There's no magical moment when you suddenly feel "ready" to start building wealth. I finally threw $50 monthly into a Roth IRA just to shut up my inside voices constant nagging. Best decision I never wanted to make.

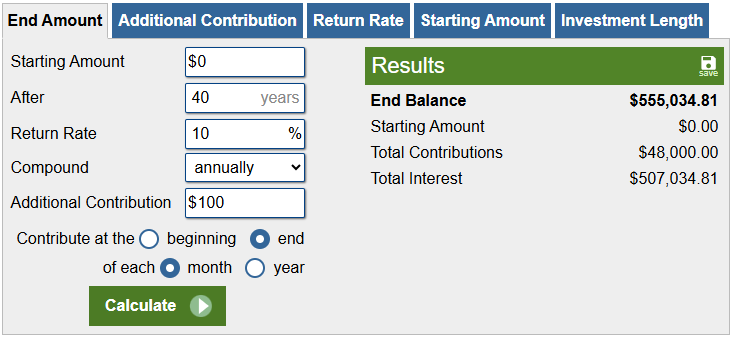

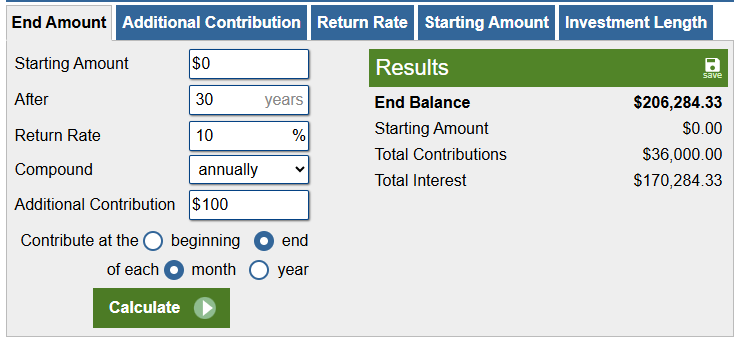

The power of compounding is in starting early, not big

The math is honestly depressing when you see what waiting costs you. If you start investing $100 monthly at age 25, you'll have about $555,000 by retirement. Wait until 35? That same monthly amount only grows to $206,000.

Ten years of delay costs you $349,000. Ouch.

My buddy thought he was behind starting at 35, so he tried cramming $800 monthly into investments. Lasted about four months before he gave up because it felt impossible. Meanwhile, a boring $100 monthly contributions could have been running on autopilot for six years now.

What to do if you feel like you’re “behind”

If you feel behind, don't panic. Start with whatever you can afford today – even $25 monthly matters. I know people who began investing at 45 and still built solid nest eggs by being consistent. The best time to plant a tree was 20 years ago, but the second best time is right now.

Mistake #2 — Not Knowing Where Your Money Goes

I've had some eye-opening conversations with clients over the years. This one guy swore he spent maybe $50 monthly on coffee. We pulled his bank statements - $247 at Starbucks alone. He was floored.

Here's what I've learned: ignoring your spending habits is basically disrespecting your own hard work. Every dollar you earn represents time and effort, so shouldn't you know where it's going?

How to do a “money audit” in 30 minutes

I've been tracking expenses for years now, and it's become this empowering habit. I know exactly what I spend on groceries ($980/month), utilities ($345), even random Amazon purchases. But even I get surprised sometimes. Last month during my quarterly review, I discovered our streaming services had crept up to $67 monthly. When did we sign up for three different platforms?

For tools, I still love a simple spreadsheet - gives me total control. But YNAB is solid if you want something fancier, and Mint's free if you're just starting out. Personally, I use my banks integrated dashboard that ties in my Wife's outside accounts so we can see all household spending patterns.

Want to do a quick money audit? Grab your last month's bank statements and categorize everything for 30 minutes. You'll probably find two or three subscriptions you forgot about and at least one spending category that's higher than you thought.

Knowledge is power, especially when it comes to your money.

Mistake #3 — Lifestyle Creep

It's so easy for people to get their first big promotion and immediately start living like they're rich. I've seen it all the time. Went from a $35k salary to $52k, and within six months they've got a car payment twice as big, a fancy apartment, and somehow less money than before. Classic lifestyle inflation in action.

The worst part? They don't even notice it happening. The nicer coffee becomes normal. The $80 dinners feel "reasonable" since they're earning more. Before they know it, their new lifestyle eats up every penny of that $17k raise. I see this even more in sales when people are making some big-time bucks.

Learn to “lock in” your lifestyle and grow your savings instead

Here's what finally clicked for me: rich people don't spend more just because they earn more. They keep their expenses steady and invest the difference. When I was selling roofs and my income shot up from $60k to $150k, I forced myself to live like I still made $52k. In fact I gave myself way less than that, roughly $35k to cover my living expenses. That extra $100k+ went straight to my emergency fund and towards paying off my house.

I use what I call "income allocation" now. As soon as my paycheck hits, 60% gets automatically transferred to savings and investments. Whatever's left is what I can spend on everything else. Can't inflate your lifestyle if the money's already gone.

The 50/30/20 rule is the version most people are familiar with and it works too – 50% for needs, 30% for wants, 20% for savings. But honestly, automating that 20% first makes everything else fall into place without you having to think about it.

Mistake #4 — Only Saving (Not Investing)

My first five years of adulting, I was that guy with $15k sitting in a savings account earning 0.01% interest, thinking I was being responsible. Meanwhile, I didn't even understand that inflation was eating away at my purchasing power faster than my account was growing. I was basically losing money while patting myself on the back for being "safe."

The lightbulb moment came when my coworker showed me his investment account. We'd both saved roughly the same amount over three years, but his money had grown to $18k while mine sat at $12k. Same timeframe, same discipline, but he was investing in index funds while I was playing it "safe" with savings.

Why investing is how money multiplies

Here's what nobody tells you – saving alone is actually risky because of inflation. That $10k sitting in your savings account today will only buy about $8,500 worth of stuff in ten years. Your money literally shrinks over time if it's not growing faster than inflation.

I finally opened a Roth IRA and threw some Vanguard funds into it and still hold to this day. You could literally start throwing a few hundred monthly into their Total Stock Market Index Fund. Nothing fancy, just broad market exposure with a 0.03% expense ratio. Set up automatic transfers so you can't chicken out or "forget" to invest.

The hardest part I've seen for most people is getting over their fear of losing money. But here's the thing – over any 20-year period, the stock market has never lost money. Short-term volatility? Sure and definitely. Long-term growth? Pretty much guaranteed if you stick with diversified index funds.

Mistake #5 — Carrying High-Interest Debt

Look, I'll be straight with you - I've always been weird about debt. Like, really weird. Even in my twenties, I'd pay off my credit card the same week I used it. Some people might think I'm nuts, but after working as a debt collector for two years in this cramped call center, I saw what high-interest debt does to people.

Credit card debt literally cancels out wealth building like fire burns through paper. I remember calling this one guy who owed $12,000 on cards charging 24.99% interest. He was paying $300 monthly but only $50 was hitting the principal. The math was brutal - he'd need 6 years to pay it off if he never used the cards again.

How to stop the debt cycle permanently

Here's my rule: anything over 6-7% interest gets attacked immediately. That's higher than most investment returns after taxes, so you're losing money by not paying it off first.

For payoff strategy when you've got substantial debt to tackle, you got two choices. Snowball method means paying minimums on everything except your smallest balance - knock that out first for the psychological win. Avalanche method targets highest interest rates first, which saves more money mathematically.

The vehicle loans I've had? Paid those suckers off in half the time. Extra payments go straight to principal, and boom - you're free.

Mistake #6 — Not Having an Emergency Fund

My dad drilled this into my head since I was probably twelve: "Always have cash reserves, son. Life's gonna throw curveballs." I thought he was being overly cautious until reality smacked me around a few times.

Five years ago, I bought my daughter this adorable corgi she named Fluffles. Within 12 hours - literally 12 hours - we're at the emergency vet with a parvo diagnosis. The treatment? $3,200. Without our emergency fund, I would've been choosing between our kid's heartbreak and going into debt.

Then there was the water heater explosion last year. Came home to water everywhere and a $2,800 replacement bill. Or when that hailstorm hit and insurance wanted a $5,000 deductible for the roof replacement.

One unexpected bill can completely derail months of financial progress. I've seen it happen to too many people.

Where to keep it (hint: not your checking account)

Start with $1,000 if that's all you can swing, it's enough to get you by for most setbacks, then build to 3-6 months of expenses as fast as possible. Don't keep it in your daily checking account where you'll accidentally spend it. I use a high-yield savings account with American Express that takes a day to transfer - just enough friction to make me think twice.

Pro tip: Keep your cash reserves in a separate financial institution so it's really out of sight and out of mind.

Building it fast? Sell stuff you don't need, pick up extra shifts, use tax refunds. Every dollar you stash away is buying you peace of mind and keeping you out of debt when life happens.

The key is keeping it boring and accessible. Not in stocks where it could lose value right when you need it. Not in your checking account where you'll accidentally spend it on groceries. Just a plain old savings account that you forget exists until life throws you a curveball.

Mistake #7 — Comparing Yourself to Others

Instagram nearly killed my motivation to build wealth. There I was, proud of hitting $25k in savings, when some random dude pops up on my feed posting about buying a $400k house at 28. I spent the next two weeks feeling like a complete financial failure, wondering what was wrong with me.

But you never know what the real story is. That "successful" person might be drowning in debt. The fancy house came with a $380k mortgage, two car loans, and maxed-out credit cards. His net worth could actually be negative $50k. But all we see is the shiny house photo, the high rise apartment, or beach getaway. Not the financial stress keeping them awake at night.

Social media is basically financial fiction. People post their new BMW lease, not their empty retirement accounts. They show off expensive vacations funded by credit cards, not their negative bank balances. It's like comparing your behind-the-scenes blooper reel to everyone else's highlight film.

Focus on net worth, not income or appearances

I started tracking my own progress instead of scrolling through other people's fake success. Every month I calculate my net worth – assets minus debts. Watching that number climb from $150k to $600k over three years felt way better than any Instagram like ever could.

You are your only competition.

Here's what changed my mindset: wealth isn't about looking rich, it's about being rich. That coworker driving the Tesla might be one paycheck away from bankruptcy. Meanwhile, my boring used Toyota and growing investment accounts are actually building real financial security. The millionaires I know personally drive 10-year-old cars and live in modest houses.

Mistake #8 — Not Asking for Help

Pride kept me stuck for way too long. After getting out of the military, I thought I could figure out this whole money thing by myself.

Spoiler alert: I couldn't.

Here's what I learned though – most people actually want to help if you ask genuinely.

My breakthrough came when I swallowed my ego and called my dad's old financial advisor, Ron. This guy had been managing money for thirty years, and instead of brushing me off, he became a mentor. He'd spend hours explaining compound interest and investment strategies over coffee. That relationship literally changed my financial trajectory.

Mentors, books, coaches, communities = shortcuts

That's when I realized I needed more than just casual advice - I went back to school to study finance. Had these incredible professors who'd worked on Wall Street and ran hedge funds. They taught me stuff you can't learn from YouTube videos.

Here's the thing: mentors, books, coaches, communities - they're all shortcuts to success. Why reinvent the wheel when someone's already figured it out?

For beginners, start with "The Total Money Makeover" by Dave Ramsey and "The Simple Path to Wealth" by JL Collins. YouTube-wise, I still watch "The Dave Ramsey Show" and "The Money Guys."

We need to normalize talking about money. I discuss investments with friends now like we used to talk about sports. It's made all of us better with our finances.

You don't have to figure this out alone.

Get the Fundamentals Right, Wealth Will Follow

“Success is nothing more than a few simple disciplines, practiced every day.” — Jim Rohn

Building wealth isn’t about luck or genius—it’s about avoiding dumb mistakes and making small, smart moves consistently.

Start early. Spend with purpose. Invest automatically. And most importantly, keep going when it feels slow. That’s how wealth is really built.

Now that you know what not to do—what’s your next move?