Building Wealth in Your 30s: The Decade That Determines Your Financial Future

“Do something today that your future self will thank you for.”

Your 30s are make or break when it comes to your financial future. You’re likely starting to hit a stride and earning more than ever, maybe starting a family, buying a home, or leveling up your career. But here’s the truth: this is the decade where wealth is built—or missed.

For me that journey into the next decade was marked by an intentional shift of priorities. My twenties were a mash up of military life in the Marines, marriage, having a kid, divorce, and getting my finance degree.

I had a good foundation of life experience and knowledge but now it was time to focus on continuously developing myself and reach for new heights. I became hyper focused on reading and consuming as much information that I could that would help me reach my goals.

Along with that came more clarity in how I would become financially independent and eventually build a legacy for my family and the people I serve.

Now here's a quick stat:

According to Fidelity, people in their 30s should aim to have at least 1x their annual salary saved for retirement. Most don’t. That’s why being intentional about your money now is one of the most powerful moves you’ll ever make. Whether you're catching up or leveling up, this guide will help you take control.

Why Your 30s Matter So Much Financially

I completely understood how crucial my 30s would be for my financial future but it's easy for people to underestimate it. Looking back, this decade was like financial puberty—awkward and transformative all at once!

The math of compound interest gets downright crazy in your 30s. If you started investing $300 monthly at 31 earning 7%, then by 40, that money would had grown to about $50,000. If you waited until 40 to start, you'd need to invest nearly double just to catch up. The difference is staggering—like tens of thousands of dollars for just waiting a few years.

Your 30s throw financial curveballs at you left and right. Between buying my first home, trying new business ventures, and getting into real estate, my expenses practically doubled.

The people who keep their spending in check during these years are will be way ahead financially. Meanwhile, some people fall for the trap of wasting years trying to keep up with neighbors who, as they later found out, are drowning in debt.

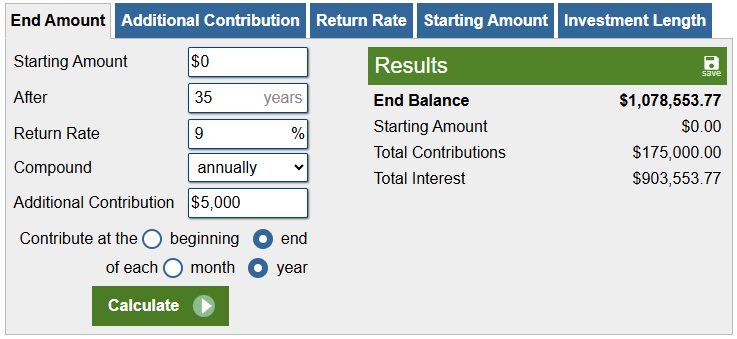

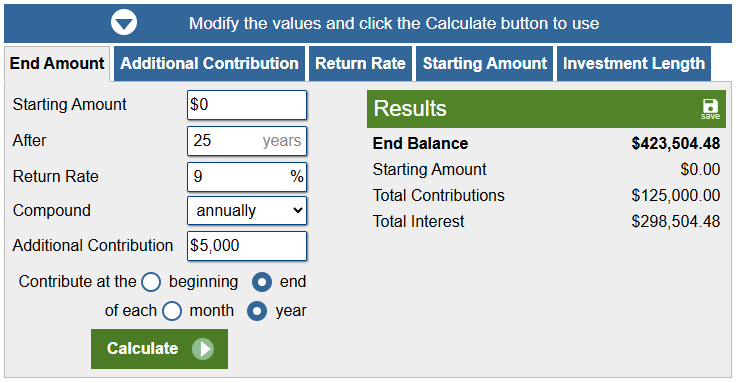

Let me share some real numbers that still make me cringe. If you invest $5,000 yearly starting at 30 earning 9%, you'll have about $1.1 million by 65. Wait until 40, and you'll only have about $425,000.

That's the cost of procrastination—literally half your retirement gone!

The habits you cement in your 30s basically determine if you'll struggle or thrive financially later. I learned this the hard way so you don't have to.

Create a Clear Financial Plan with Specific Goals

For years, my financial "plan" was basically hoping I'd have enough money at the end of the month. Spoiler alert: hope isn't a strategy! Everything changed when I finally sat down and mapped out actual goals with deadlines.

Short-term goals should be specific and achievable within 1-3 years. Instead of "save more," I wrote down "save $90,000 for a house down payment by December 2026." That clarity is game-changing! Long-term goals take more patience—my big one is having $1.5 million net worth by age 40. Seeing that number makes daily money decisions easier.

When I was in roofing sales I used to obsess over my commissions, but tracking my net worth monthly showed me the bigger picture. Your income can be impressive while your net worth stays stuck if you're spending it all! My net worth started at a modest level (thanks to limiting debt), but watching it slowly climb into positive territory was super motivating.

The debt-versus-investing question kept me paralyzed for too long. Here's what finally worked: I paid off my mortgage balance of $175,000 in 1.5 years, then took that same momentum and applied it to investing. Some financial gurus would disagree, but this approach helped me sleep at night.

For tracking, a simple spreadsheet has been my go-to for the past 5 years—it's free and shows everything in one place. It's also important for keeping historical records.

I used to use Mint, especially for budgeting, but have found that many banks offer a similar integration feature. Now I use my American Express dashboard because I can link all household external accounts and see exactly where the cash is flowing. Either way, checking in weekly keeps me honest and on track.

The hardest part isn't making a plan—it's sticking to it when life throws curveballs your way!

Maximize Your Income Without Burning Out

I spent my early 30s working crazy hours thinking that was the only path to financial success. Ended up with a bigger paycheck but also high blood pressure and a marriage on the rocks. Not exactly the win I was hoping for!

The biggest income jump I ever had? Switching companies after 5 years grinding with minimal payoff and then doubled my income. Turns out, staying put was costing me thousands annually. Research shows job-hoppers earn 50% more over their lifetimes than company loyalists.

That said, don't hop every 6 months—aim for 2-3 solid years to avoid looking flaky. You should be focused on adding value wherever you are. Once you've provided as much value as you can then it's time to move on.

Side hustles saved my bank account and sanity, but they aren't all created equal. I pressure washed driveways when I was ramping up in a career that had very long relationship based sales cycles. It switched things up by being outside, working with my hands, and it was satisfying to watch everything get clean instantly.

The nice thing is that it was completely transactional and a few jobs a month brought in $500 monthly for just a few hours of work. It was short term gratification that allowed me to stay afloat while my other career foundation was forming.

The trickiest part when you start making "good" money? Avoiding lifestyle inflation when your income grows. I automatically redirect well more than half of every check to investments before I can spend it. This one habit has probably added $200K to my net worth in the last couple of years without feeling any pain.

I've watched too many colleagues get trapped in jobs they hate because they inflated their lifestyles to match their salaries. They drive nicer cars than me, but they're stuck in golden handcuffs while I'm building options.

Investing in skills pays dividends forever. The $2000 I spent to attend a Tony Robbins conference has returned at least ten times that amount in higher earnings.

Eliminate Bad Debt and Avoid New Traps

Debt nearly ruined me in my early 30s. I was making good money and it wasn't like I was living paycheck to paycheck but those minimum payments were eating away at my income. The wake-up call? Calculating how much interest I was paying yearly—over $7,000 just disappearing!

For tackling credit cards and personal loans in the past, I tried both the snowball method (smallest balance first) and the avalanche method (highest interest first). The math says avalanche saves more money, but honestly, those quick wins from the snowball approach kept me motivated. I still remember the feeling of satisfaction from killing my first card balance.

Student loans these days can be the biggest headache for most people. Refinancing the interest rate from 6.8% to 4.2% can result in saving about $3,800 over the loan term. Not all refinancing offers are created equal though—some can actually extend your timeline which would cost more in the long run.

Your credit score matters way more than you may have initially realized. For instance, improving your score from 640 to 780 could help you get qualified for a mortgage that saves you $192 monthly compared to your previous options. That's over $69,000 in savings over 30 years!

The car payment trap is real. I've heard so many people tell me "I'll always have a car payment" like it's just part of everyday life. I do not subscribe to that belief! I've known plenty of people who make way more than I do but are always broke because of their $850 monthly payment on a fancy truck. Meanwhile, I drive a 13-year-old Toyota I bought with cash. Not as flashy, but that's $10,200 more I invest yearly.

The debt calculator at unbury.me was eye-opening—showed me I could be debt-free 3.5 years sooner by adding just $200 monthly to my payments. That extra effort in my 30s means entering my 40s with breathing room instead of financial stress.

Remember, the goal isn't being totally debt-free necessarily—The goal is eliminating bad debt that's keeping you from building wealth.

Invest Smart—Even If You’re “Late”

I started investing in my 20's but had to pause things due to life circumstances and didn't start investing again until I was 34 and felt like I'd already missed the boat. Man, was I wrong! While I do wish I was able to contribute more earlier, your 30s are still prime investing years—you've got roughly 30 years until retirement, which is PLENTY of time for compound interest to work its magic.

When I finally ran the numbers, I realized that investing $500 monthly starting at age 35 could still grow to over $600,000 by retirement at 65 (assuming a 7% average return). Not too shabby for a "late" start! The worst time to start investing isn't your 30s—it's "never."

Your company's 401(k) match is literally free money. I embarrassingly left about $8,000 on the table by not contributing enough to get my full match during my early working years in the military. Don't make my mistake! At minimum, contribute whatever percentage gets you the full employer match.

For years I was intimidated by all the investment options. Then I discovered the simplicity of index funds—they're like buying a tiny slice of hundreds of companies in one purchase. My portfolio is mostly low-cost total market index funds, and I sleep well at night knowing I'm not trying to outsmart the market.

Target-date funds are another great option if you want something even simpler. Pick the fund with a year close to when you'll retire, and they handle the rest. The fees are slightly higher, but the convenience is worth it when you're was just starting out and gaining momentum.

As for how much you need—the old rule of "80% of your pre-retirement income" stressed me out. Then I tracked my actual spending and realized I could live comfortably on much less. Focus on your personal needs rather than arbitrary rules. For me, that meant adjusting my savings target from an impossible-feeling $2 million down to a more realistic $1.2 million.

Building Your Financial Safety Net: What I Learned the Hard Way

Some people never thought they'd need an emergency fund until their car's transmission died the same week their company announced layoffs. Talk about a wake-up call! Avoid ever sweating through that kind of nightmare, I've never gone below 4 months of expenses saved. Trust me, having that cushion isn't just about the money—it's about sleeping at night.

Insurance was something I totally messed up in my early thirties. I figured I was healthy, so why bother? Then my a co-worker became temporarily disabled after a work accident. Twelve months without income is something I can't imagine stomaching. Now I tell everyone: term life insurance (10x your income) and long-term disability are non-negotiable if anyone depends on your paycheck.

Estate planning sounds like something for rich old folks, but it's really about control. I've heard too many stories of people passing away without a will, and watching that legal messes convinced me to get mine done. It took just one afternoon to set up a basic will, update beneficiaries on my accounts, and assign medical power of attorney.

These three things—emergency savings, proper insurance coverage, and basic estate documents—they're like the triangle of financial security. Each one protects what you're building from different angles.

From Spender to Builder: Mindset Matters

It's easy to take the easy route and think wealth is just for lucky people or those born into money. After years of paycheck-to-paycheck living in my 20's, I finally realized my own thinking was keeping me broke. The stories we tell ourselves about money are powerful stuff—mine was all about "I deserve this purchase" rather than "I deserve financial freedom."

Shifting from seeing myself as a consumer to an investor changed everything. Instead of asking "Can I afford this?" I started asking "Is this moving me toward financial independence?" That one mental switch probably saved me thousands. It wasn't easy though! I still remember the pain of passing up a new car while colleagues upgraded.

For anyone wanting to rewire their money brain, "The Psychology of Money" by Morgan Housel absolutely is a must read. I also got hooked on Zig Ziglar and Tony Robbins type seminars—practical, no-nonsense advice that actually works for regular people.

Your thirties are make-or-break for wealth building. I spent half of mine building a business foundation before getting serious, and that's time I can't get back, but time that was necessary. The compound interest you miss in these crucial years is brutal. Stop winging it with your finances—intentional money management now sets up your whole future.

The decisions you make in your 30s ripple through the rest of your financial life. You have time, income, and the ability to make compound decisions that will pay off for decades.

Whether you’re just starting or cleaning up a financial mess, this decade is your launchpad.

Start where you are. Use what you have. Build the life—and legacy—you deserve.